property tax in france 2020

The level of the tax last. French income tax.

France Tax Income Taxes In France Tax Foundation

The two property taxes in France are the taxe foncière and the taxe dhabitation although the latter is gradually being phased out by 2020 for most households.

. There are two main property taxes in France plus a wealth tax according to Jessica Duterlay a tax associate at Attorney-Counsel a law firm with offices in London and Nice France. Tuesday 10 November 2020. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property.

Tax on 2021 profits. Depending on your circumstances and the choices you make the method of taxation of the rental income you receive may be either. This French housing tax deemed unfair by President Macron is set to be abolished for up to 80 of households by 2020.

If you are a non-resident. Those who adopt the régime réel use. With the period for submission of income tax returns in France having closed last month tax notices will soon be.

We are pleased to announce the latest release of our free 26-page guide to French inheritance laws. More households will be exempt from the taxe dhabitation this year as the gradual abolition of the tax continues. The company tax rate is 28 for profits up to 500k Euros and 3333 above this.

30 74517 to 157806. From February 2021 to. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to 27519 and 30 for income above this.

14 27794 to 74517. Up to 10064 0 From 10065 to 25659 11 From 25660 to 73369 30 From 73370 to 157806 41 As of 157807 45. The calculation depends on the number of family quotient quotient familial units available.

160 for the 22nd year. Taxe dHabitation 2020. Friday 10 January 2020.

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. Thursday 09 July 2020. French Income Tax Assessments 2020.

Tax rates remain the same as last year but bands have been indexed for inflation. Real estate profit tax. 9 for the years after the 22nd year.

Nil 9964 to 27794. Impôt sur les sociétés. For the 2020 taxe foncière the maximum income levels based on 2019 income is.

Married couples and those in a civil partnership are exempt up to. The planned measures will see an initial 30 reduction in your. This leads to a full income tax and social surtaxes exemption of capital gains after a holding period of 30 years.

108 rows It is going to be much the. French company tax rates. This tax is at the rate of 3 on income up to 500000 and at the rate of 4 on income above 500000.

For properties more than 5 years old stamp duty is 58. 362 or 265 additional tax 2 to 6 if CG 50000. 20 or 30 75.

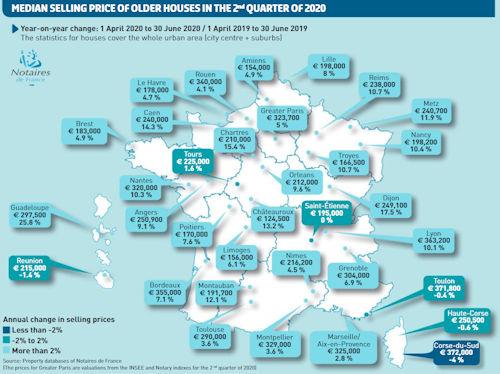

Guide to Inheritance Laws and Taxes in France 2020. The projections based on preliminary contracts in mainland France foresee for the end of February 2022 a continuation of the annual price increase.

Best Lawyer Logos Branding For 2020 Lawyer Logos Beam Local In 2022 Lawyer Logo Lawyer Branding Branding

Why You Should Buy A House In France In 2022

Assessor Property Tax Data Scraping Services Property Tax Data Services Online Assessments

Vacation Rentals And Yoga Retreats Prospective Investments In 2020 Business Photos Investing Creating A Business Plan

Global Property Guide On Greece Property Guide Global Guide

Taxes In France A Complete Guide For Expats Expatica

Taxe D Habitation French Residence Tax

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

French Property Analysis Of The Market Notaires De France

France Tax Income Taxes In France Tax Foundation

This Past June France Saw Its First Security Token Offering Based On A Real Est

Taxes In France A Complete Guide For Expats Expatica

Landlord Guide To Rental Property Myhousedeals Blog Rental Property Being A Landlord Rental Property Investment

Feature Your Property At Europe S Premier Real Estate Event Exp Commercial Brokerage Real Estate Commercial Real Estate Real Estate Sales

French Property Tax Considerations Blevins Franks

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

Facebook Cover Photos Vol 3 Cover Pics For Facebook Facebook Cover Facebook Cover Photos